Hey you! Yes, you in the building industry, still manually preparing your contractor payments reporting for the ATO.

Don't worry, we're not here to tell you off—considering you're one of the majority of people still reporting manually on your taxable payments. (And, if my sources are correct, hating every second that it keeps you from doing whatever it is you'd prefer to do. Trust me, my list of things I'd rather be doing is mighty long.)

According to the ATO, 88% of TPARs (that's Taxable Payment Annual Reports, to those of us not in the know) lodged this year were on paper.

"So what?" you might ask.

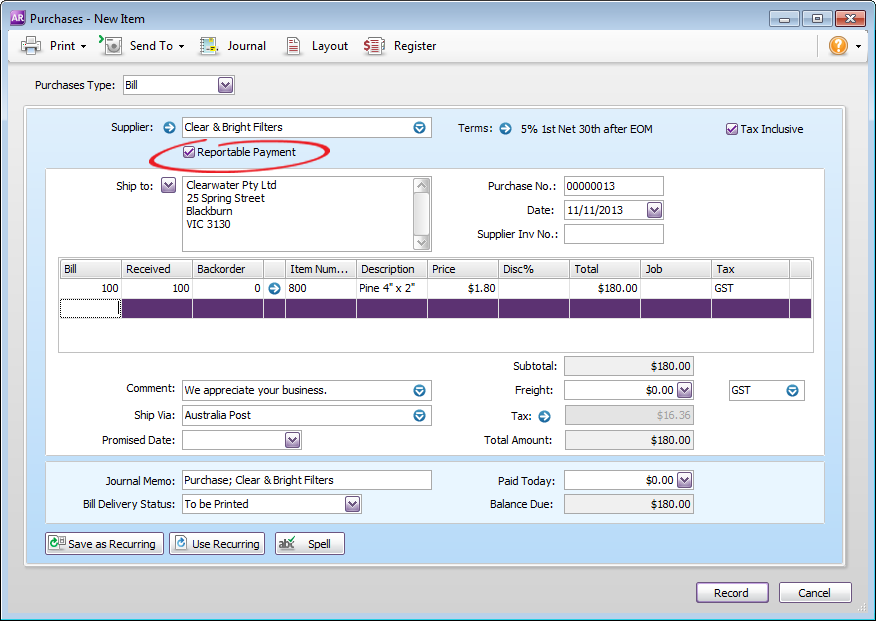

Well, we told our developers here at MYOB that they needed to make life easier for you, and then we cracked the whip on them, so that all you need to do to report on taxable payments is mark the transactions that need to be reported as they come up (you can even set them to be automatically marked).

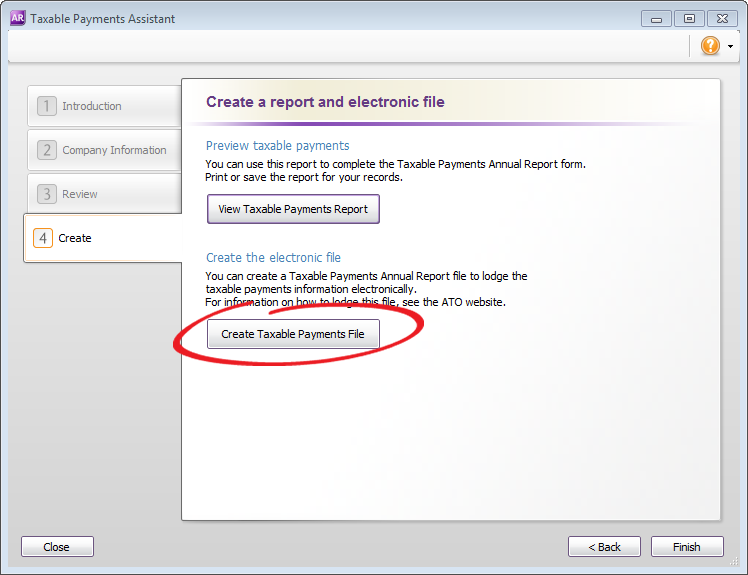

Then when reporting time rolls around, there's a nifty little assistant that'll take all the marked transactions and put them into an electronic form for you. You then lodge that with the ATO through their business portal. What could be easier? (Well, probably lots. But this sure beats scrabbling through the past year's transactions, arguing about whether they need to be included or not, the night before you need to send the form off, right?)

Check out these videos for information on how to set this up in AccountRight*—or if you're a LiveAccounts whiz, the help site will give you more information.

*Just a tip: if you're still on AccountRight v19, you might want to consider moving onto AccountRight 2013—nothing wrong with the v19 contractor payments reporting, but 2013 really works a treat!

So, if reporting your 2012/13 taxable payments was about as fun as that last camping trip with the in-laws, then do yourself a favour and get onto this feature now.

The latest AccountRight news direct from our product development team.