Bank Reconciliations

Hi Everyone! Reconciling your bank accounts is one of the most important bookkeeping tasks. Depending on the business it can be done daily, weekly, monthly or quarterly. What is a bank reconciliationand why is it important? A bank reconciliationis the process of matching the transactions in your accounting software with the actual transactions in your bank account. It allows you to check that all bank transactions have been entered into your software, ensuring your financial reports are an accurate reflection of your business. It also helps find data entry/payment errors that need to be corrected and verifies your cash flow. How do I reconcile my accounts? Depending on your software and whether you use bank feeds there are different procedures for reconciling your bank accounts. But the end result will always be the same, the Closing balance on your bank statement will match the Calculated balance in your software. You can find step-by-step instructionsfor your software in these help articles: AccountRight What if my account doesn't reconcile? If your account doesn't reconcile you need to find what is causing the out of balance and make the necessary changes. Some of the common causes for an out of balance amount are: the wrong date has been entered the wrong balance on your statement has been entered not all bank transactions have been recorded in your software a transaction is selected that doesn't appear on the bank statement a transaction amount has been recorded incorrectly, eg, $217.50 instead of $271.50 a previously reconciledtransaction has been deleted or changed in your software causing it to become unreconciled To help you find the cause and correct any errors our help articles have detailed information on reconcilingyour bank accounts: AccountRight: Resolving out of balance bank reconciliations We hope you find this useful. As always, if you do need help please start a new post. Our team of MYOB technical support staff and the generous MYOB Community is always happy to help.4.1KViews3likes0CommentsSetting up bank feeds

Hi everyone, Bank feeds allow information from your financial institution to be sent straight to your accounting software so you can save time on your data entry and aid in the reconciliation process. Feeds are available for a wide range of financial institutions and account types, check outAustralia | New Zealand for a full range of financial institutions. In order to set up bank feeds in AccountRight, you need: to be theonline owner(usually the person who set up your AccountRight subscription) yourMYOB account login details the details of the bank or credit card account you're setting up for bank feeds have an active AccountRight subscription (per company file) Note: Your AccountRight online file does not need to be online to set up or use bank feeds, but you’ll need an internet connection. Bank feeds can be applied for using Banking>>Bank Feeds>>Manage Bank Accounts>> Get Started with Bank Feeds (or Add or remove a bank account). You will be prompted to enter your my.MYOB account details to apply for those feeds. Once you are logged in, you do need to follow the on-screen prompts. Check out Help Article:Set up bank feeds for AccountRight for full detailed instructions on setting feeds up for your financial institute. Bank feeds can be applied for using Banking>>Manage Bank Feeds>>Add bank feed. We hope you find this useful. As always, if you do need help please start a new post. Our team of MYOB Support Moderators and the MYOB Community is always happy to help.4KViews0likes0CommentsElectronic payments with a bank file

Hi everyone In AccountRight you can make bulk payments to your suppliers and employees by creating an electronic file. This electronic file is known as an ABA file or bank file. Using this method to make bulk payments not only saves you time but also helps prevent incorrect amounts being paid. Before you can process electronic payments you will need to complete a few setup tasks. This help article will walk you through the setup: Setting up electronic payments for bank files How do I record and create an electronic payments? You can record the AccountRight transaction and create the ABA file in just a few steps: record the Pay Bills, Spend Money or Payroll transactions, making sure the Electronic Payment option is selected go to Prepare Electronic Payments and select the payment transactions you want included in the file click on Bank File and OK when you receive the message "The transaction will be recorded before the bank file is created" the Save As window will open, enter a name for the ABA file and click on Save. log into your internet banking and upload the ABA file You can find detailed information and instructions in these help articles: Making electronic payments with bank files Rejected electronic payments I reversed a transaction, how do I remove it from the Prepare Electronic Payments window? You can select the reversal transaction by itself and click on Bank File. The AccountRight transaction will be recorded to update the electronic clearing account but the bank file won't be created as it's a negative amount. This post, Reversals in the Prepare Electronic Payments window, has detailed information to assist with this. Can I recreate a bank file? Yes you can, but first you will need to delete or reverse the original electronic payment transaction. Once you've done that, go to the Prepare Electronic payments window and reprocess the electronic payment. Some users may be able to use a feature called Direct Payments which allows you to make batch payments using your debit or credit card directly from your software. See these help articles for more information: AccountRight We hope you find this useful. As always, if you do need help please start a new post.3.6KViews2likes0CommentsUsing Bank feeds

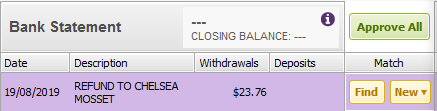

Hi Everyone Automatic bank feeds can be used for a variety of purposes in the day to day processing, some of them being easy transaction entry, getting updated banking information, and most commonly as a tool for reconciliation Once you have set up your Bank feeds these transactions will flow through to your MYOB Software available for you to action that transaction. There are two main actions that can be taken with a bank feed transaction; Match or Allocate Matchis when you have already recorded the bank transaction in your MYOB Software and you are looking at matching that bank transaction to that transaction. Click on the Find option next to the associated transaction, enter the desired search criteria if required, choose the already recorded transaction, and then select Match & approve The following links can be referred to understand the process: How matching works Approving a bank feed Matching a bank feed to multiple transactions Select the drop arrow to the right of the transaction, selecting Match transaction, and choose the desired transaction(s) before selecting Save. For more information on matching check out the following Help Articles and Forum posts: Matching bank transactions Matching multiple bank transactions to one payroll transaction. Allocateis used when you have yet to record that transaction in MYOB Software. In the Bank Feeds window, select an unmatched bank feed transaction, clickNewandselect the type of transaction you want to create, then match & approve. Click onAllocate Meand select the account against which you want to record the withdrawal or deposit. Allocating bank transactionsexplains this in detail. Can't find the answer to your question here? Take a look atBank Feed FAQ'sAlternatively, do please start a new post. Our team of MYOB Support Moderators and the MYOB Community is always happy to help.2.5KViews0likes0Comments