Lodging your Business Activity Statement (BAS) or Income Activity Statement (IAS)

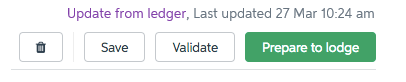

Hi everyone Australian businesses that are registered for GST or have employees need to regularly lodge activity statements, Business Activity Statement (BAS) or Income Activity Statement (IAS),with the ATO that contain GST, PAYG and other business information. If your turnover is less than $10 million you'll be eligible to lodge your BAS using Simpler BAS. This means that fewer GST fields will need to filled and you won't need to use as many Tax Codes. For more information on Simpler BAS please refer to the ATO website. Online lodgement From AccountRight 2016.3 onwards, if your company file is online you can lodge your BAS and IAS straight from your software. These help articles will guide you through setting up and lodging your activitystatements online: Get ready to lodge activity statements online Simpler BAS reporting Prepare your activity statement online Recording your ATO payment or refund BAS not reconciling with your AccountRight reports? The first thing to try is refreshing the online BAS statement by clicking on Update from ledger. If you've made any changes to the tax codes set up you will need to update the ledger for those changesto affect the current statement. If this doesn't resolve your issue, check the tax codes setup by opening the online statement, click on Settings and select Set up activity statement fields. Make sure that all applicable tax codes have been selected. Manual lodgement Your other option for lodging your BAS in AccountRight is manual lodgement. These help articles have detailed information on using BASlink: Prepare your activity statement manually BASlink FAQs Pay Liabilities and BASlink We hope you find this useful. As always, if you do need help please start a new post. Our team of MYOB technical support staff and the generous MYOB Community is always happy to help.3.1KViews0likes0CommentsBAS Articles to get your BAS sorted

Hi Everyone As it is drawing close to BAS due date, we thought we would share some of our Help Articles on BAS to aid you in that process. The new AccountRight range allows for the user to prepare their BAS online and file it directly with the ATO online. Our Help Article Prepare your activity statement onlinewould be able to assist with that process. Wish to prepare it locally? Help Article:Prepare your activity statement manually For those clients on the AccountRight Classic range, we do recommend taking a look at the following Help Articles and Support Notes: Lodge your activity statement (BAS or IAS),Checking your BAS prior to lodgement & BASLink FAQs We hope you find these resources useful. As per always, if you are still requiring assistance don't hesitate to post on this Forum.3.2KViews0likes0Comments