If you’re considering moving from AccountRight v19 to the new AccountRight in the new financial year, this release will make it even easier for you to upgrade, to get online and to invite others to access your file.

We’ve also made the necessary ATO updates to help keep Australian businesses compliant, so if you pay employees using AccountRight, make sure you install this update before your first pay run in July.

|

Have questions about closing your financial or payroll year? Join a free EOFY webcast and let an MYOB expert explain what you need to do. Or visit our EOFY Hub for a checklist of things to do. |

You’ll also notice significant speed improvements when preparing general journal entries and recording customer payments.

Upgrade and get online in one easy step

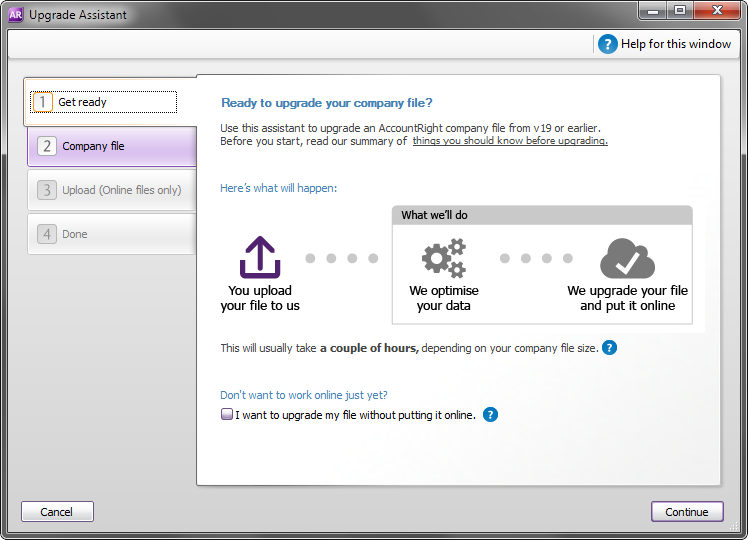

If you haven’t already moved over to the new AccountRight, the Upgrade Assistant now makes it really easy for you to upgrade from AccountRight v19 and to get online.

You can now upload your file to the cloud as part of the upgrade process. If there are any issues with the upgrade, we’ll try fixing them, and we’ll keep you informed if there are delays.

Note that you can still choose to upgrade your file offline if you're not ready to work online.

Invite users easily

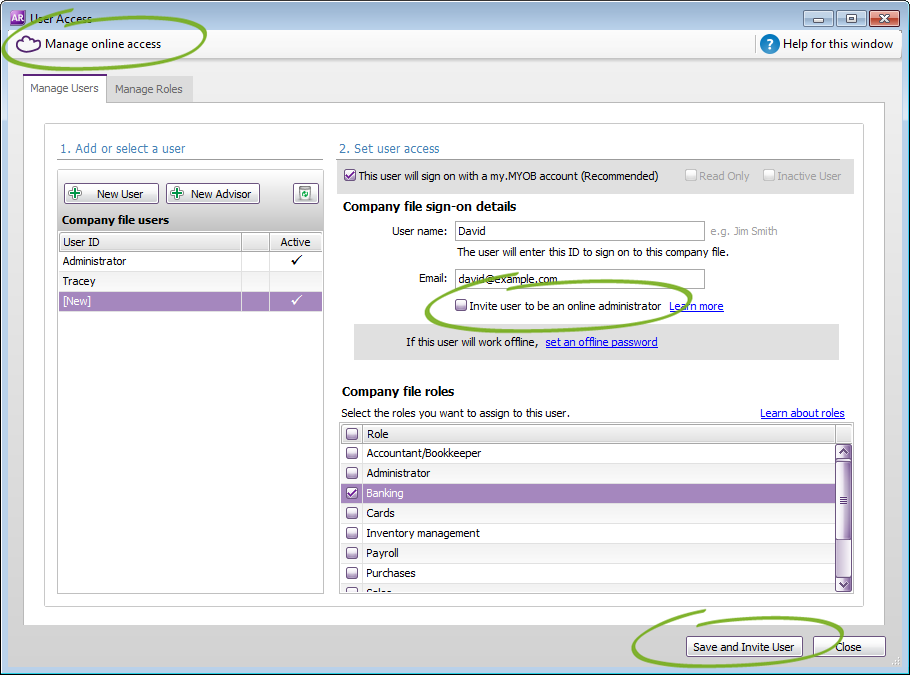

Inviting others to access your online file has just got a lot easier. Now when you create a user account in the User Access window, an email will automatically be sent to the user inviting them to access the file online.

And if you want to allow the user to check out the file, you can choose to make them an online administrator.

Which all means you don’t need to log into the my.MYOB website to set up new users. But if you need to cancel access, or change a user’s access level (administrator to file user, or back), you’ll still need to do this via the my.MYOB website - just click the Manage online access button in the User Access window.

Compliance changes for Australian businesses

This year we've made a few updates that’ll help your business keep up with all the ATO changes that take effect from 1 July 2015. Here are a couple of the changes to note:

Updated PAYG tax tables

The PAYG tax tables have been updated for the 2015-16 payroll year. You need to load the tax tables after closing the 2014-15 payroll year, and before you start your first pay run for July. Learn about updating your tax tables

Payment summaries

In this release we’ve made some small changes to the comply with recent ATO requirements, like changing ‘Magnetic Media’ references to ‘Electronic Media’ in the Payment Summary Assistant, and adding the ATO’s privacy statement to the payment summary forms.

Remember that you need to give your employees their payment summaries by July 14. Learn about preparing your payment summaries

Speed improvements

In this release, you’ll notice great speed improvements when recording customer payments in the Receive Payments window, especially if your file is online.

If you record lengthy general journal entries, you’ll also see big speed improvements when deleting transaction lines in the Record Journal Entry window. And if you try recording an unbalanced general journal entry, you’ll get an alert much faster so you can fix the issues quicker.

Easier customer and supplier payments

The Receive Payments and Pay Bills windows now automatically refresh if you record or edit a sale or purchase in another window. That saves you from having to close and reopen the payment windows after making a change to an invoice or bill while recording the payment.

You can also refresh these windows on demand by clicking the new Refresh button at the top of the windows.

Note that the windows won’t automatically refresh after recording:

- Recurring transactions using the To Do List

- Credit and debit settlements (like refunds)

- Cash sale and purchase transactions using the Bank Register

- Pre-conversion sales and purchases.

Fixes and improvements

In this release we’ve addressed several issues and made a few tweaks:

- An issue causing the Bank Feeds window to crash has been resolved.

- An issue that caused a crash when sorting the All Sales tab of the Sales Register by the Amt Due column (if quotes were in the list) has been fixed.

- An issue causing an error icon to randomly appear while editing a general journal entry in the Record Journal Entry window was fixed.

- The Delivery Status is now retained when a purchase order is converted to a bill or sale quote is converted to an order.

- Discounts applied to pre-conversion purchases in the Pay Bills window now post the journal entry correctly.

- When viewing the linked expense account for discounts, clicking the Expense (or Contra) Account for Discounts arrow now opens the Purchases Linked Accounts window, not the Sales Linked Accounts window.

- [Australia only] An issue where a Pay Liabilities transaction amount would show as double in the Transaction Journal has been fixed. This would occur if the Warn for Duplicate Cheque Numbers preference was selected and a Pay Liability transaction was recorded with a duplicate cheque number.

- [Australia only] If a supplier had the Report Taxable Payments option selected in their card in AccountRight v19, their transactions will now remain reportable after upgrading to AccountRight 2015.3.

- [Australia only] An issue where reportable transactions would not appear in the Taxable Payments report if the Reportable option in the supplier's card was not selected has been fixed.

- [Australia only] A note has been added to supplier cards and the Pay Superannuation and Prepare Electronic Payments windows reminding you to ensure the payee banking details are correct before processing the payments.

- [Australia only] The BPay and MYOB logos on the default M-Powered invoice templates have been updated. Note that if you use customised M-Powered forms, the logos won’t be updated automatically on those forms.

How to get the update

This update will be available to all AccountRight subscribers over the next few days. If you’re using:

- AccountRight 2015, 2014 or 2013, you'll be prompted to update when you open your company file. Or, you can download the installer by signing in to my.myob.com.

- AccountRight 2012 or AccountRight v19, visit myob.com/upgrade to download the latest version.

Using Windows XP or Server 2003?

AccountRight 2015.3 comes with the latest Microsoft .NET Framework software, which isn’t compatible with Windows XP or Server 2003. This means both the PC and Server Editions of AccountRight 2015.3 won’t install on Windows XP or Server 2003.

We recommend Windows 7 or later for PCs, and Windows Server 2008 SP2 or later for servers.