GST On Orders Not Calculating Correctly

We have a problem with the GST being calculated incorrectly when we change a sales order to an invoice.

I have attached the screen shots and procedure being used when we convert orders to invoices.

The Selling Detils for all items has the Tax Code is GST, the Inclusive/Exclusive box is not ticked and the Actual Price is used for Calcuating Sales Tax.

Hello daviders

Thank you for sending that through. I've done a bit more digging and discovered that with Time Billing invoices, there is an issue with the 'Tax Inclusive' box being recognised properly at all times by the software. In short, even if it is unticked, the software can randomly read it as being ticked and will adjust line item prices and subsequently GST calculations accordingly. From what I understand, this can happen randomly and at different points of the invoicing process. In my software, I encountered your issue immediately upon creating the order. As in, I entered $2,600 for the generic items x2 and my GST calculated to $472.72. In order to correct this, I ticked 'Tax Inclusive' before entering $2600, and then unticked it, and the misread didn't happen. Basically, ticking and unticking 'Tax Inclusive' is a refresher of sorts so that it is read properly.

In your case, you were able to create the order successfully with $5,200 and 10% GST of $520 equalling $5,700, which is correct, but then when entering that invoice again, for whatever reason the 'Tax Inclusive' box didn't get recognised as unticked, even though it was. So then, when you were putting in the real item numbers, their prices were changed to $2,363.64 and the total GST to $472.73 in an effort for the software to reconcile the $5,200 (before tax) total on the order. Thus resulting in that -$520 apparently 'owed.'

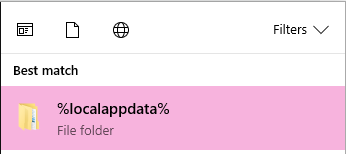

I've attached a screenshot showing how I replicated your scenario, which is also how you would be able to workaround this in the future. When you see the GST or line item pricing change as you did in the example you sent me, you'll want to tick and untick the Tax Inclusive box and then re-enter the figures in the line item as needed. I think because you re-entered the $2,600 without ticking and unticking Tax Inclusive, the -$520 was never prompted to disappear.

With all this said, I do understand this is an irritating fluke that has obviously caused you frustration and inconveinence. I have checked with another team and they are aware of this issue, but at this point I cannot provide a timeframe in which it would be permenantly fixed. I do apologise for this but I hope the workaround advised will assist you for the time being.