TriciaWaters

4 years agoExperienced User

Reversing a payroll entry

I have processed an employee with the wrong tax amount taken out via AccountRight, Payroll function. This has been sent to the ATO. Note that I do not have auto EFT payments set up so the correct a...

- 4 years ago

Hi TriciaWaters

Thanks for your post. To reverse a payroll transaction:

- go to Find Transactions, find that pay transaction and open it by clicking on the zoom arrow

- click on Edit and select Reverse Transaction

- If the pay being reversed is a cheque or electronic payment, a message will be displayed advising it will be recorded as cash. Click Yes to proceed.

-

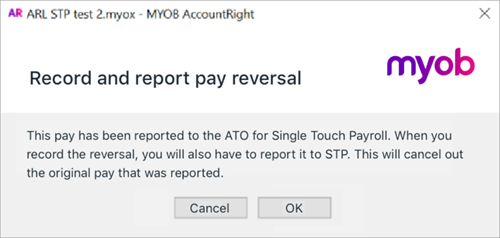

Click OK to the following confirmation message:

-

Click Record to process the reversal.

- When prompted to declare the reversal to the ATO, enter the name of the Authorised sender and click Send.

You can find these step-by-step instructions in this help article: Changing a recorded pay

Please let me know if you need further help.

If my response has answered your enquiry please click "Accept as Solution" to assist other users find this information.