Hi Fran_29

Yes I think you will need to reverse the pay and re-enter it. There are other ways but this is the safest.

I should clarify my comments re Lump Sum A etc. If the accrued leave relates to a period after Aug 1993, the amount is not Lump Sum A unless the termination is caused by things like genuine redundancy. This means that any payout on termination for accrued annual or LSL is simply included as part of the employee's income. There is no special tax treatment for this amount and it is taxed at the employee's marginal rates. So under Phase 1, most employers would use a payroll category such as Unused Holiday Pay in MYOB and assign this to Gross Payments for STP Reporting purposes.

However, while not covered in the linked MYOB Article, Phase 2 requires a whole lot more detailed reporting when it comes to Leave. Any leave or leave related payments must be reported as a Leave Type and not included in the Gross Payments. This particularly affects terminated employees.

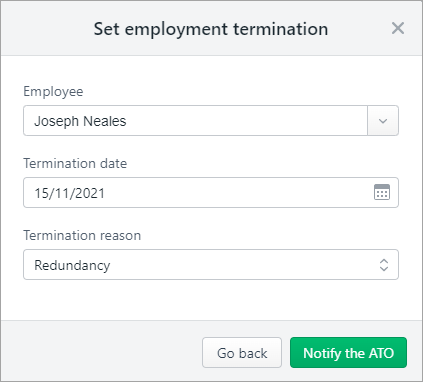

This is where things will get tricky for employers as you may need to create more specific payroll categories to accommodate the new reporting requirements. For example Unused Holiday Pay that is not Lump Sum A, needs to be assigned to 'Unused Leave on Termination'. However for genuine redundancy employees, Unused Holiday Pay needs to be assigned to Lump Sum A.

So some employers will need to create and use additional payroll categories, for example Unused Holiday Pay Regular and Unused Holiday Pay Redundancy. This will allow you to assign these to different reporting categories.

Regards

Gavin