I agree that many MYOB users run Jobs as Cost centres and not as Projects so I would not endorse changing what works for the vast majority of users.

If however this discussion is about technical accounting I do think we need to look at the big picture.

Revenue Recognition

The general principle of revenue recognition in accounting is to recognise revenue when it is realised or realisable, next is to match the costs as best one can that relate to the revenue being recognised.

For many MYOB users who do run "Project" type jobs the jobs usually start and finish in a short time frame so the way MYOB handles it is reasonable.

When a job however runs over a longer period be it a month or a year, decisions need to be made as to what if any revenue should be recognised. What Michael is proposing is to defer all revenue and all costs to the compeltion of the job. This is called the "Completed Contract Method" and while simpler to do is not the prefered accounting method for Longer term contracts. The more correct method to deal with revenue recognition for these Long term jobs is to recognise revenues and associated costs as a percentage of completion. This gets a lot more complex, requires judgement and is hard to "program".

I note that even Wikipedia comments that :

"There are very few contracting ERP software packages which have the complete integrated module to do this."

In reality what many larger MYOB users do month to month is try to schedule the billings to roughly match the progress of the contract, in doing so they are correct to recoginse this as Revenue along the way. Often costs also roughly match the effort put in and progress of the Job.

If true Percentage of completion accounting is needed then on a month to month basis, or at year end at least, all they need to do is run a Job List report to See by Job Total Revenue - Total Costs = Job Profit and Margin % - If the Job Profit Margin % is;

- below the forecast overal profit % then either Revenue needs to be accrued or Costs defered into WIP;

- if it is above the forecast overall profit % then either Revenue needs to be deferred or Costs accrued

The total of the accrual or deferal can be booked as one simple summary journal entry that reverses at the start of the next month. It does not need to be be booked job by job.

Sure if you run a lot of jobs the MYOB reports may not be sufficient to do the above easily and flexibly. If so then look at the Job Add-ons as mentioned above.

Many larger contracting businesses use our Business Intelligence software BI4Cloud to do just that. http://myob.com.au/addons/listing/52/business-intelligence-for-myob/

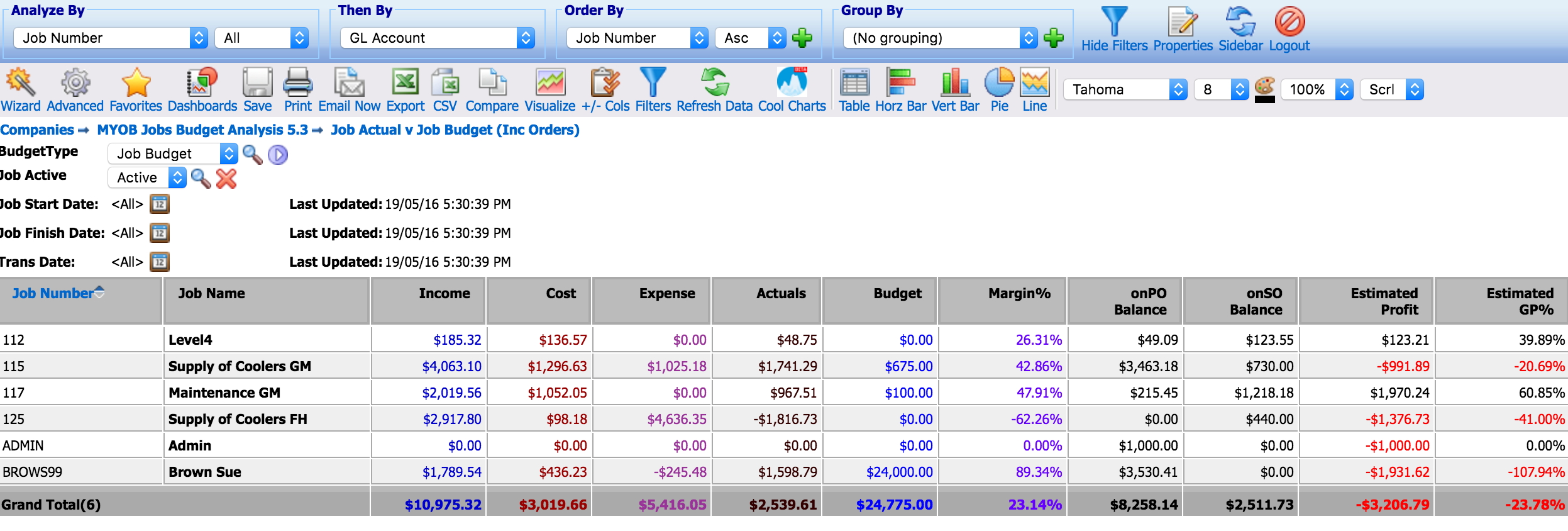

We include a Job report that includes Job Actual, Job Budget, Purchase and Sales Orders yet to Invoice and calculates Forecast Job Profit. This allows them to quikcly and easily determine any WIP or Revenue accruals at month end. Job reports can also be run over financial years and based on finish date it you want to do the Completed Contract method.

Here is an Article suggesting how to use our Job reports to account for Project type jogs - https://support.bi4cloud.com/hc/en-us/articles/212693677-Use-Jobs-to-Manage-Project-Type-Jobs-and-WIP

Jennifer Kelly CA

Related Content

- 8 months ago

- 7 months ago

- 9 months ago

- 2 years ago

- 12 months ago